nj ev tax credit 2020

The credit ranges between 2500 and 7500 depending on the capacity of the battery. New Jersey has the longest permitting timeframes in the US.

2017 2018 2019 2020.

. 2018 2019 2020 2021 2022. Electric Vehicle EV Rebate. 2019 2020 2021 2022.

Audi 2021 e-tron 222. Updated March 2022. EV charging stations are often not addressed in New Jersey municipal permitting codes and therefore are considered a prohibited use Developers face long delays in getting stations approved through planning and zoning boards often requiring use variance parking variance etc.

1 - Theres now a 5000 rebate for EVs with an MSRP under 55000. Nj ev tax credit 2022. So im optimistic theyll get it.

For buys between 117 and July the state is working on a process to claim the 5k directly in retrospect. BMW 2020 i3 REX 168-223. Sales Tax Exemption - Zero Emission Vehicle ZEV NJSA.

2020 NJ Resident EV buyers gets 5000 in tax rebate and no sales tax. Just talked to the Princeton shop. 2015 2016 2017 2018 2019 2020.

New Jersey already waives the 7 sales tax on electric vehicle purchases and the federal government offers a 2500 to 7500 income tax credit based on a cars battery capacity. Jun 08 2020 at 434pm ET. 0 You Save 3776 49500.

The Charge Up New Jersey program is funded on an annual basis with 30 million from the Plug-In Electric Vehicle Incentive Fund which was established by the EV Act NJSA. After the failure of the Build Back Better bill in late 2021 the existing proposals for the expansion of the EV tax credit were abandoned. NJEITC is a cash-back tax credit that puts money back into the pockets of working families and individuals including the self-employed who earn low to.

With the Fed EV tax rebate gone for 2020 this is the next best thing along with no sales tax for EV purchase. Office of the Governor Governor Murphy Affirms Electric Vehicle Rebate Eligibility Effective as of January 17 2020 So if you are waiting to buy a Tesla. The incentives could be combined with a current federal tax credit to potentially bring the sticker price of a 40000 electric vehicle for example into the 28000 range.

The EV Act codified the goal of 330000 registered light-duty electric vehicles in the state by 2025 putting New Jersey. Apparently the funding will be available in July. 5432B-855 The New Jersey Sales and Use Tax Act provides a sales and use tax exemption for zero emission vehicles ZEVs which are vehicles certified pursuant to the California Air Resources Board zero emission standards for the model year.

Back in January we reported that New Jersey Governor Phil Murphy signed into law legislation that will make buying an electric vehicle in the. Base models of. - No sales tax - 5000 NJ incentive - 500 NJ charger install incentive.

New Jersey Earned Income Tax Credit We envision building a New Jersey where everyone can afford lifes basic needs. Increasing the use of electric vehicles is a critical step to secure New Jerseys clean energy future Murphy said. Because the 2022 credit will be a refundable tax credit probably 12500 in 2022 payable on my taxes in 2023 it cannot be used as a down payment in 2022.

EV 6 58 khw 774 khw 7500. You may be eligible for a credit under section 30D g if you purchased a 2- or 3-wheeled vehicle that draws energy from a battery with at least 25. For NJ buyers after July 2020 the 5k will be deducted from the purchase price.

0 0 You Save 4366 58400 Audi 2021 e-tron sportback. Charge Up NJ EV Rebate NJ State Sales Tax 6625 Cost After Incentives. The New Jersey Board of Public Utilities NJBPU Charge Up New Jersey program offers point-of-sale rebates to New Jersey residents for the purchase or lease of a new light-duty EV.

January 1 2020 to december 31 2022. 4825-1 et seq and signed by Governor Murphy on January 17 2020. The credit begins to phase out for a manufacturer when that manufacturer sells 200000 qualified vehicles.

4200 0 You Save 3010 33745 BMW 2019 i3. So that 50k Model Y purchase gives you 5000 in. The EV tax credit remains at 7500 for all electric models except those made by Tesla and General Motors.

Its a GREAT year to buy an EV in the Garden State. For more information. So install one this year get 500 from NJ and then 30 back from the feds.

Of Environmental Protection allows manufacturers who sell or lease qualified LEVs to earn and. On January 17 2020 Governor Murphy signed S-2252 into law PL2019 c362 which created an incentive program for light-duty electric vehicles and at-home electric charging infrastructure. Charge Up New Jersey promotes clean vehicle adoption in the state by offering incentives of up to 5000 for the purchase or lease of new eligible zero-emission vehicles including battery.

The exemption is NOT applicable to partial. NJ will provide 500 towards that and the federal 30 tax credit for installing one was just RETROACTIVELY extended to Dec 31 2020. For those not familiar with New Jerseys EV program.

New Jersey Energy Policy Watch Exact Solar

June 15 2020 Ms Aida Camacho Secretary Via Electronic Submission To Board Secretary Bpu Nj Gov New Jersey Board Of Public Uti

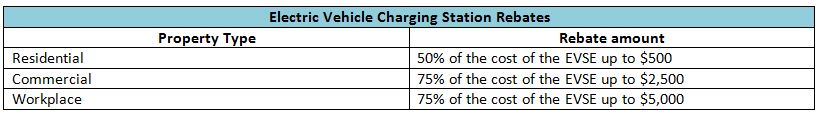

Rebates And Tax Credits For Electric Vehicle Charging Stations

![]()

Nj Charge Up Tax Credit Tesla Motors Club

Take Action Nj Sustainable Business Council

Receive Up To 7 500 In Federal Tax Credit Towne Hyundai

Us Ev Sales Tumble In 2020 But Ev Load Increases With More Charging Stations S P Global Commodity Insights

Rebates And Tax Credits For Electric Vehicle Charging Stations

June 15 2020 Ms Aida Camacho Secretary Via Electronic Submission To Board Secretary Bpu Nj Gov New Jersey Board Of Public Uti

Rebates And Tax Credits For Electric Vehicle Charging Stations

Rebates And Tax Credits For Electric Vehicle Charging Stations

Ev Incentives Ev Savings Calculator Pg E

Rebates And Tax Credits For Electric Vehicle Charging Stations

Rebates And Tax Credits For Electric Vehicle Charging Stations

Rebates And Tax Credits For Electric Vehicle Charging Stations

New Chevy Bolt Ev For Sale In Egg Harbor Township Nj

Pse G Gets Approval To Develop Ev Charging Infrastructure In New Jersey Daily Energy Insider